In this article, I will show you how to open RD Account in SBI Online using 3 Easy steps. State Bank of India(SBI) is the largest multinational public sector bank in India. Like many banks, SBI also provides an opportunity for investment in the form of term deposits like RD and FD. While we will look into FD(fixed deposit) in future articles, here we will only see how to open RD account. RD is also known as Recurring Deposit, is a type of term deposit offered by most of the Indian banks including State bank of India. It is a type of investment tool through which people can deposit and earn good returns depending upon the rate of interest.

RD account can be opened by both offline and online mode. In offline mode, one needs to visit their local Branch and open RD account by simply filling a form. But in online mode, you don't have visit any branch. You can easily open RD account from your home by following some simple steps which we are going to look below.

How to Open RD Account in SBI Online Using 3 Easy Steps

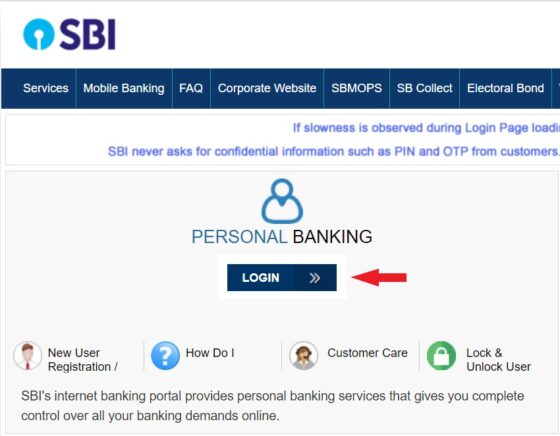

Step 1: Login to Account

You need to first open the SBI Login page by visiting www.onlinesbi.com as shown below. Here you need to click on LOGIN under PERSONAL BANKING as shown below.

It will redirect you to below account login page where you need to click on CONTINUE TO LOGIN.

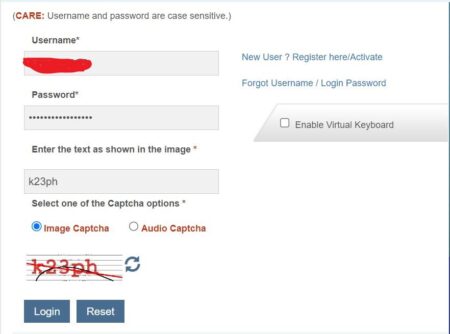

Here you need to fill you Username and Password which you would have got it after applying for online netbanking. Then enter the Image Captcha or Audio Captcha and Click on Login.

NOTE:

Username and Password to login. So you need to first activate your Internet banking. To apply you can follow the steps given on SBI official website.

After Login, in the second Login factor authentication it will ask you to enter OTP sent to your registered mobile number and then Click on Submit.

NOTE:

Click here to resend the OTP button.

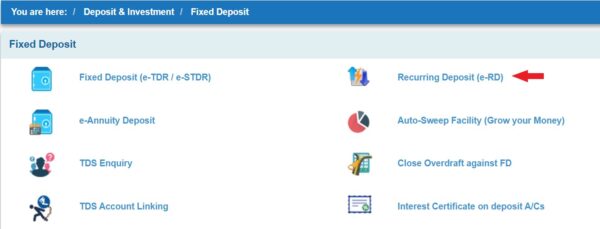

Step 2: Deposit & Investments

Once successfully logged in, you need to tap on Deposit & Investment on the top row as highlighted below.

You will see few of the options on the drop down. On those, you need to click on Fixed deposit option as highlighted below.

In the fixed deposit section, you will see an option called Recurring Deposit(e-RD) as highlighted below. Click on it to open.

Step 3: Open RD Account

Here as we can see there is only one kind of deposit i.e e-RD(Recurring Deposit), so this will be auto selected as shown below. You just need to click on Proceed to continue.

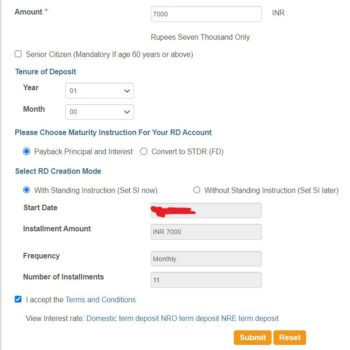

It will redirect you to below e-RD section where you need to fill all the details like the amount, tenure, maturity type and RD creation mode. If your age is 60 years or more then select Senior Citizen(Mandatory if age 60 years or above) checkbox as well. Once all the details are filled out, click on I accept the Terms and Conditions check box and then click on Submit.

- Amount: You need to fill the installment amount that you want to be deducted from your savings bank account as selected.

- Tenure: This is amount of time period for which you want to open your recurring deposit. In other words, it is the time period till which your monthly installment will get deducted.

- Maturity: Here you need to select what you want to do after completion of the tenure. You can either select

Payback principal and interestwhere all the amount will be credited back to your selected saving account orConvert to STDR(FD)in which your total amount will be converted to a fixed deposit(FD). - RD Creation Mode: Here you need to select an option to specify how you want the amount to be deducted. If you want the amount to be deducted automatically from your savings account then select

With Standing Instruction(Set SI now)where it will automatically create your rest of the installment date and deduct the the amount on the same date. If in case you want to manually deposit the installment every month then selectWithout Standing Instruction(Set SI later).

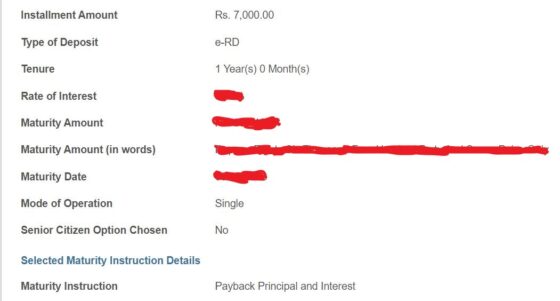

In the next section, you will be asked to confirm all the filled details along with the Rate of Interest and maturity amount you will get. Once confirmed, click on Submit.

NOTE:

Rate of Interest keeps changing depending on multiple factors. To know the latest Rate of Interest for Recurring Deposits(RD), you can check SBI official website.

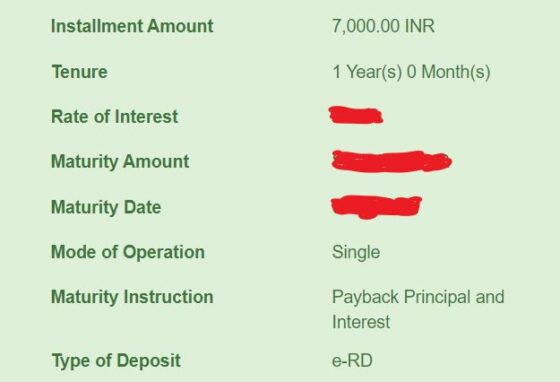

You will see e-RD account opened successfully with below confirmed details.

You can verify your given details as shown below. You can click on View/Print to view or save the below details for your reference. You can verify your recurring deposit(RD) just opened from Deposit Accounts section under Account Summary.